Could Employee Ownership Be Part of Your Succession Plan?

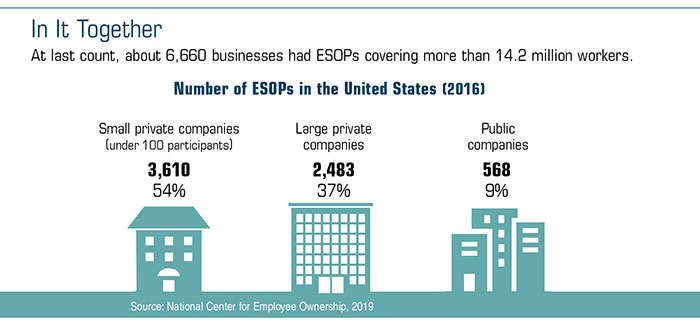

An employee stock ownership plan (ESOP) is a type of retirement plan that enables employees to have an ownership interest in the company. An ESOP may be a particularly good option for small-business owners who dont plan to pass the reins to family members when they retire, but instead have loyal and capable managers who are interested in running and owning the company.

Proponents of ESOPs believe that an ownership mentality often results in improved efficiency and productivity. Employees understand that its in their interest to help ensure the companys long-term success.

How ESOPs Operate

Annual cash contributions are made to the ESOP and used to purchase stock from the company, or the company may contribute the stock directly. In either case, the company can take a tax deduction for the value of each years contribution, while the cash stays with the company.

Unlike other retirement plans, ESOPs are permitted to borrow money to purchase company stock. The company then makes annual contributions to the ESOP in the amount equal to the ESOPs principal and interest payments on the loan and uses the contributions to pay back that debt. The companys contribution as a whole is deductible, so the interest and the principal on the loan are deductible as well.

With an ESOP, an employee never buys or holds the stock directly while still employed with the company. If an employee is terminated, retires, becomes disabled, or dies, the plan will distribute the vested shares of stock in the employees account.

ESOP participants are investing heavily in a single stock, and their investment is tied to the financial health of the business. If the company declines in value, the ESOP may also. Thus, an ESOP should generally supplement assets in a retirement plan, not replace them.

A Tax-Friendly Exit

There may also be tax incentives for a retiring owner who sells a business to an ESOP rather than to another buyer. If the ESOP owns at least 30% of the company after the sale, the tax on the sale may be deferred by reinvesting the proceeds in domestic U.S. securities (qualified replacement property). No tax is due until the replacement securities are sold. If they are held until death, a stepped-up basis may apply, and the original gain may never be taxed (conditions apply).

ESOPs can be complicated to establish and maintain. You are strongly advised to consult an attorney with experience in the formation and maintenance of qualified employee retirement plans.

All investing involves risk, including the possible loss of principal. There is no guarantee that any investing strategy will be successful.