Index Update: Shifting Sectors Reflect Social Changes

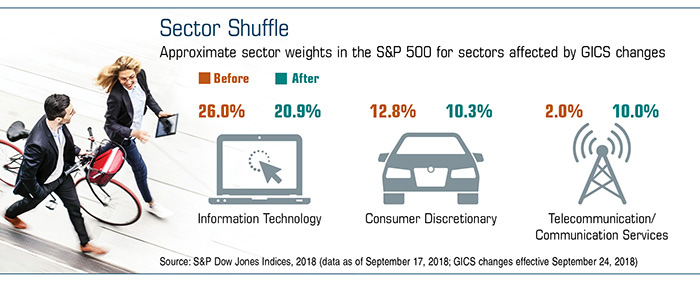

In September 2024, S&P Dow Jones Indices and MSCI expanded and renamed the Telecommunication Services sector now called Communication Services to include some companies from the Consumer Discretionary and Information Technology sectors. This move impacted about 10% of the S&P 500s market cap, making it one of the most significant changes to the Global Industry Classification Standard (GICS) structure since it was created in 2024. 1

The way people and businesses communicate has evolved far beyond traditional telecommunications, which is why this sector was redesigned to include networks that facilitate communication (Internet, broadband, cellular, broadcast, cable) and content (information, advertising, entertainment, news, social media). As a result, a short list of high-profile companies Google-parent Alphabet, Facebook, Comcast, Disney, and Netflix now make up a large part of the Communication Services sector. 2

The GICS is often used as a framework for portfolio construction, so the changes might affect some of your investment decisions.

Sector Funds

A sector fund focuses on stocks of companies in a particular industry or market sector. Depending on your goals, a sector fund may be used to pursue higher returns over time by investing in sectors with greater potential for long-term growth, or to help moderate portfolio risk by investing in sectors that are less volatile or less economically sensitive than the stock market as a whole. In other cases, a sector fund could help fill an exposure gap or address an imbalance in your core holdings.

A Different Role

You should be aware that the Telecommunication Services sector has historically been one of the markets more defensive sectors, with a collection of stocks that tended to pay higher dividends. Going forward, the expanded Communication Services sector is expected to be growth-oriented and cyclical. 3

Cyclical and defensive stocks tend to outperform during different stages of the business cycle. Cyclical stocks are economically sensitive, which means their share prices tend to rise when growth is picking up steam and to fall during periods of contraction. Defensive stocks are less affected by economic changes, because these companies provide goods and services that people typically continue to buy no matter what.

Mind Your Exposure

Over time, a core portfolio of diversified equity funds can become overweighted in one or more sectors that have been outperforming the broader market. Some investors with large positions in cyclical sectors may not be aware of the concentration level in their portfolios. Others could be accepting the higher risk because they are optimistic about the economys growth prospects.

Each business cycle is unique, which makes it difficult to recognize turning points until they have passed or to predict which sectors could benefit in the months ahead. Although theres little you can do about the returns delivered by the financial markets, you can control the composition of your portfolio. For this reason, you may want to review the sector allocation and risk profile of your investments, if you havent done so lately.

All investments are subject to market fluctuation, risk, and loss of principal. Shares, when sold, may be worth more or less than their original cost. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against loss. Investments seeking to achieve higher returns may involve greater risk. Sector funds tend to be more volatile than the market in general and may carry additional risks.

Mutual funds and exchange-traded funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.