SECURE Act Changes That Matter to Small Employers

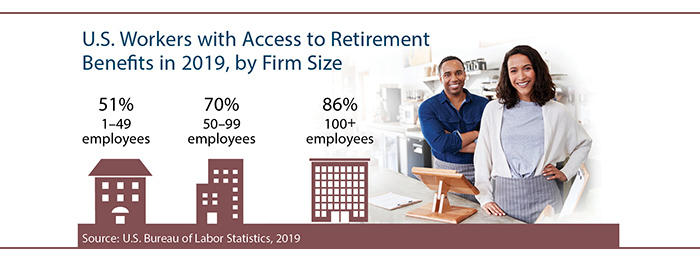

Many people who work for small businesses dont have access to retirement benefits. The SECURE Act includes provisions that could make it easier and more affordable for business owners to provide retirement plans and help their employees save money for retirement.

Here are some of the specific rule changes that could affect small businesses starting in 2024.

Retirement Plan Tweaks

To help workers track their progress toward retirement income goals, employers must provide participants in defined contribution plans with annual statements that estimate how much their retirement plan assets would provide on a monthly basis if converted into a lifetime income stream. In addition, auto-enrollment safe-harbor plans may now automatically increase participant contributions until they reach 15% of salary. (The previous ceiling was 10%.)

For plan years beginning on or after January 1, 2024, part-time workers age 21 and older who log at least 500 hours for three consecutive years generally must be allowed to contribute to a qualified retirement plan. (The previous requirement was 1,000 hours and one year of service.) However, these participants may be excluded for nondiscrimination testing purposes, and employers will not be required to make matching or nonelective contributions on their behalf.

Open MEPs Explained

Effective January 1, 2024, employers will be able to offer retirement plans by joining multiple employer plans (MEPs) regardless of industry, geographic location, or affiliation.

Open MEPs, as they have become known, offer economies of scale, allowing small employers access to the types of pricing models and other benefits typically reserved for large organizations. (Previously, groups of small businesses had to be related somehow in order to join an MEP.)

The legislation also eliminates the one bad apple rule. This change means that the failure of one employer in an MEP to meet plan requirements will no longer cause others to be disqualified.

Bigger Incentives

The tax credit that small businesses can take for starting a new retirement plan has increased. Employers can take a credit equal to the greater of (1) $500 or (2) $250 times the number of nonhighly compensated eligible employees or $5,000, whichever is less. The previous credit amount allowed was 50% of startup costs up to $1,000 ($500 maximum credit).

There is also a new tax credit of up to $500 for employers that launch a SIMPLE IRA or 401(k) plan with automatic enrollment. Both of these tax credits are available for three years.